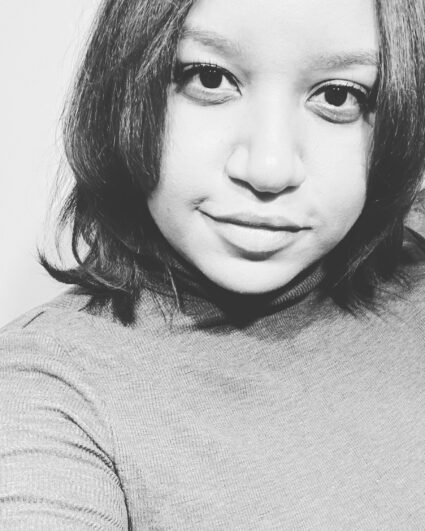

Jessica Frelow

Jess is a storyteller and real estate enthusiast. She explores the depth of the human experience through her writing and as the editor of Discretionary Love.

As a licensed real estate salesperson in New Jersey, she acts as a liaison between the journey and the comfort of home.